TINS and the Global Economy's Cliff Dive: There Is No Substitute

You are receiving this post/email because you are a patron/subscriber to Of Two Minds / Charles Hugh Smith. This is Musings Report 2024-44.

Last week, I described 10 "keystones" in the global economy which were little-understood vulnerabilities in what appears to be a robust, stable system of interlocking (i.e. tightly bound) arches: remove one single piece--the keystone--and to everyone's surprise, the entire arch collapses.

Today I want to explore why the decay of these keystones will push the global economy off the cliff: there are no substitutes that can replace them--what we can summarize as There Is No Substitute (TINS).

This runs counter to what I call the mythology of Eternal Growth, i.e. Progress, which holds that there is always a substitute for whatever once propped up the economy. If the wild fisheries have been depleted by overfishing, then we'll replace them with fish farms. If jobs in factories disappear, will replace them with white-collar service jobs.

The past century offers so many examples of substitutes arising through innovation that this process seems infinite: an even better substitute will naturally arise because the advance of technology is unstoppable. This is one of the themes of my new book, The Mythology of Progress.

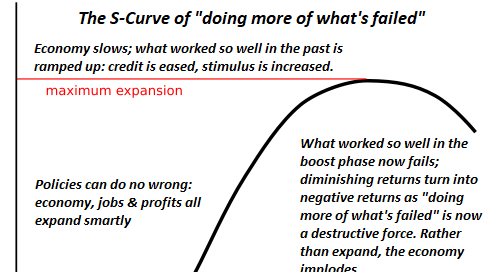

But this process of substitution is not infinite or guaranteed. There are no substitutes for the keystones in the global economy that have reached diminishing returns and are sliding down the back of the S-Curve.

Many of the proposed substitutes do not fill the void left by what was depleted or lost. Fish farms don't actually replace wild ecosystems, nor do tree farms replace native forests. These may be financial substitutes, but they are not systemically functional substitutes: they can't fulfill the functions of what they're supposedly replacing.

The same illusion of substitution is manifesting in the global economy, but there are no substitutes for the expansion of the money supply and debt, commoditization and near-zero interest rates--the core dynamics of financialization and globalization--nor are there any substitutes for overcapacity and overproduction.

It's easy to claim that AI will effortlessly solve all our problems, but the reality is AI is not a systemically functional substitute for what's sliding off the cliff.

The mythology of eternal growth focuses exclusively on the benefits of technological innovation as the source of solutions to every problem. Again, there are so many examples of this that it's easy to believe this is a Force of Nature rather than an artifact of a one-time confluence of low-cost energy, new technologies and financialization that cannot be extended indefinitely because the financial keystones are crumbling.

The money supply is an overlooked keystone of growth. The money supply must expand at around 6% annually for the economy to expand by 2% to 3%. Should the money supply shrink, tech innovations are not substitutes: growth falters and the economy contracts.

The same is true of credit/debt: for the economy to expand 3%, debt must expand at much higher rates. Once the returns on expanding money supply and credit diminish, it takes $3 or more of new debt to create $1 of additional GDP/growth. As the expansion of new credit needed to move the needle reaches extremes, it takes $10 or even $12 of new credit to boost GDP by $1.

This is why global debt has exploded to $320 trillion, over three times the global GDP of about $100 trillion.

While our attention is drawn to new technologies and products, the reality is that growth isn't dependent on innovation, it's dependent on the accelerating expansion of the money supply and credit.

CHS NOTE: I understand some readers object to paywalled posts, so please note that my weekday posts are free and I reserve my weekend Musings Report for subscribers. Hopefully this mix makes sense in light of the fact that writing is my only paid work/job. Who knows, something here may change your life in some useful way. I am grateful for your readership and blessed by your financial support.

Keep reading with a 7-day free trial

Subscribe to Charles Hugh Smith's Substack to keep reading this post and get 7 days of free access to the full post archives.